Chinese manufacturer, Youngman, has invested EUR10m (US$13m) in Spyker for 29.9% of the capital in a deal subject to completion of due diligence.

A statement from Spyker said Youngman had undertaken to not “exceed the

29.9% threshold and therefore has no ambition to make a mandatory offer on all outstanding shares in Spyker.”

Youngman has conditionally paid EUR2.3m to Spyker for 46m Class A shares and it is expected the remaining EUR7.7m will be paid in instalments on or before the end of January, 2013, provided all conditions have been “timely met.”

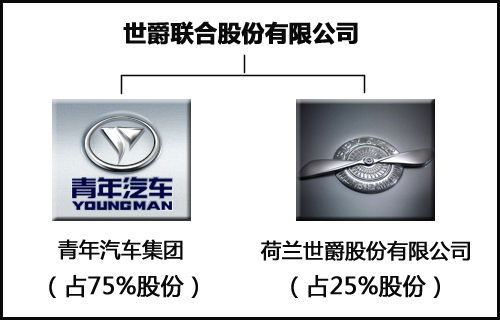

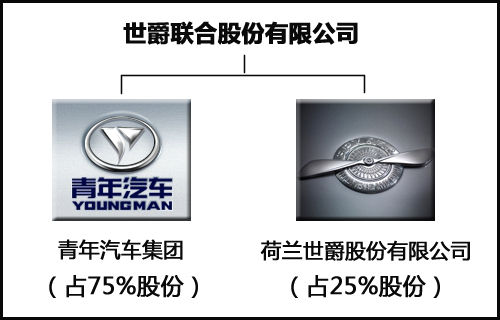

Youngman and Spyker have established a joint venture known as Spyker P2P in which Youngman holds 75% of the shares and Spyker 25%.

The Chinese company agreed to make a cash contribution in the amount of EUR25m while Spyker has made its contribution by transferring the technology it developed for the Spyker D8 Pekingto-Paris, a US$250,000 four-door Super Sports Utility Vehicle.

Youngman’s contribution will be paid in instalments in accordance with the development and manufacturing plan of the SSUV with the objective of launching that car by the end of 2014.

Additional models on the SSUV’s aluminium space frame and technology are being

contemplated.

Spyker and Youngman have jointly incorporated a second joint venture called Spyker Phoenix in which Youngman holds 80% of the shares while Spyker holds 20%.

Youngman will contribute the rights to the Phoenix platform as developed by Saab Automobile in 2010/2011 to which Youngman acquired a licence in 2011 as well as provide all required funding.

Spyker Phoenix will develop and manufacture a new range of premium car

models based on the Phoenix platform whose models will be positioned higher than the comparable Saab models. Spyker Phoenix products may be manufactured in Europe and China.

“Signing the Transaction Documentation is a milestone for Spyker,” said Spyker CEO, Victor Muller. “We have conditionally secured our short and mid-term funding and forged a strong partnership with Youngman which will allow us to expand our product range with the long awaited Spyker D8 Peking-to-Paris SSUV and possibly additional models on the basis of that platform.

“Moreover, Spyker has secured a 20% stake in the development of all Phoenix-based vehicles, whose development will be funded by Youngman in the coming years.

All in all, being virtually debt free, refinanced and with an exciting product range in the making, this strong partnership with Youngman allows Spyker to enter a new chapter in its history.”

Spyker and Youngman set up a new joint-ventur. Spyker P2P BV Youngman has 75 percent of the shares of the joint venture and will contribute 25 million euros. Spyker gets the remaining shares and in return brings its technical expertise along. Spyker P2P B.V. is created for the D8 Peking-to-Paris to build the super-SUV with a price tag of $ 250,000 excluding taxes.

There is also Spyker Phoenix, an ambitious joint venture that will makethe new models of Saab. The joint venture aims for up-market. The cars get a Spyker logo on the bow to fight the battle against BMW and Audi. Youngman has 80 percent of the shares, Spyker 20 percent.

P2P = Paris to Beijing

世爵青年SUV将上市 定天价将高揽胜4倍

网通社2012年12月7日报道 2012年12月6日,青年汽车集团在一向倚重的海外收购项目上终于有了新成果,其与荷兰世爵股份有限公司正式签署了股权认购协议。在协议内容上包含了三方面:1.青年投资世爵1000万欧元认购世爵29.9%股份;2.青年和世爵成立合资公司——世爵联合股份有限公司;3.青年和世爵成立第二个合资公司——世爵凤凰股份有限公司。

青年汽车集团和荷兰世爵股份有限公司成立的合资公司——世爵联合股份有限公司可以说将是世爵发力的起脚点,青年将出资2500万欧元获得该合资公司75%的股份,在产品层面不低于保时捷水平的高端奢侈轿车、轿跑将被研发,而另外一款全新四门超级SUV也将在2014年正式问世。

全新SUV的亮点不在于它的由来,而是其高达25万美元的定价足足比路虎全新一代揽胜的售价区间高了3-4倍之多。可以说这样的产品战略足以显示出双方对于合资公司的信心,青年汽车之所以与世爵“联姻”很大程度上也是因为看重后者在品牌方面的影响力。

青年汽车并没有走传统自主品牌的发展道路,“品牌至上”的宗旨使得其在海外的收购成为了发展中的核心内容。不过这样的思路需要更多的时间去收获成果,此次收购能否达到青年汽车的预期让我们拭目以待。

Leave a Reply